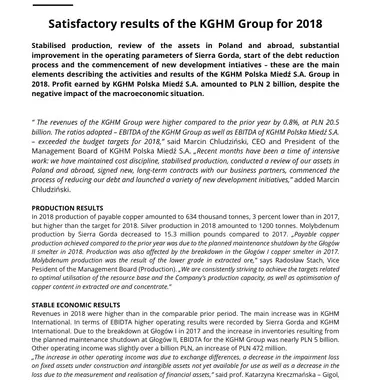

Satisfactory results of the KGHM Group for 2018

“The revenues of the KGHM Group were higher compared to the prior year by 0.8%, at PLN 20.5 billion. The ratios adopted – EBITDA of the KGHM Group as well as EBITDA of KGHM Polska Miedź S.A. – exceeded the budget targets for 2018,” said Marcin Chludziński, CEO and President of the Management Board of KGHM Polska Miedź S.A. „Recent months have been a time of intensive work: we have maintained cost discipline, stabilised production, conducted a review of our assets in Poland and abroad, signed new, long-term contracts with our business partners, commenced the process of reducing our debt and launched a variety of new development initiatives,” added Marcin Chludziński.

PRODUCTION RESULTS

In 2018 production of payable copper amounted to 634 thousand tonnes, 3 percent lower than in 2017, but higher than the target for 2018. Silver production in 2018 amounted to 1200 tonnes. Molybdenum production by Sierra Gorda decreased to 15.3 million pounds compared to 2017. „Payable copper production achieved compared to the prior year was due to the planned maintenance shutdown by the Głogów II smelter in 2018. Production was also affected by the breakdown in the Głogów I copper smelter in 2017. Molybdenum production was the result of the lower grade in extracted ore,” says Radosław Stach, Vice Pesident of the Management Board (Production). „We are consistently striving to achieve the targets related to optimal utilisation of the resource base and the Company’s production capacity, as well as optimisation of copper content in extracted ore and concentrate.”

STABLE ECONOMIC RESULTS

Revenues in 2018 were higher than in the comparable prior period. The main increase was in KGHM International. In terms of EBIDTA higher operating results were recorded by Sierra Gorda and KGHM International. Due to the breakdown at Głogów I in 2017 and the increase in inventories resulting from the planned maintenance shutdown at Głogów II, EBIDTA for the KGHM Group was nearly PLN 5 billion. Other operating income was slightly over a billion PLN, an increase of PLN 472 million.

„The increase in other operating income was due to exchange differences, a decrease in the impairment loss on fixed assets under construction and intangible assets not yet available for use as well as a decrease in the loss due to the measurement and realisation of financial assets,” said prof. Katarzyna Kreczmańska – Gigol, CFO and Vice Pesident of the Management Board (Finance) of KGHM Polska Miedź S.A. “Moreover, thanks to the use of factoring we accelarated the turnover of receivables, which led to higher cash held at the end of 2018.”

CONTINUATION OF STRATEGIC PROJECTS

Work continues under the Deposit Access Program. Planning work began on the siting of the GG-2 shaft. Thanks to the conclusion of discussions with local authorities, the Gmina (municipality) of Żukowice requested a change in the Study of Conditions and Directions of Land Management and in the Municipal Land Management Plan.

Under the Metallurgy Development Program another stage in the ramp-up of the Głogów I smelter was accomplished. The Company is pursuing a program of adaptation of its installations to the requirements of BAT Conclusions for the nonferrous metals industry and to restrict emissions of arsenic. The BATAs Program involves 32 investment projects at the Głogów metallurgical plant, including 20 new projects, as well as 14 projects at the Legnica plant, including 8 new ones.

Work also accelerated on the Copper Scrap Plant program being advanced at the Legnica Copper Smelter and Refinery. This division is undergoing a broad investment program comprising among others the construction of a new RCR (Revolving Casting-Refining) furnace.

In 2018 we commenced the expansion of the Żelazny Most Tailings Storage Facility. This key investment for KGHM guarantees safe operations by the Company in the copper belt in the coming years.

In 2018 we advanced numerous development projects for the domestic companies of the KGHM Group. We implemented a variety of solutions, such as enhanced coordination of key entities. We eliminated overlapping activities, which will help to increase the value of the Group. We developed the concept of the KGHM Group Council, a body which is aimed at providing comprehensive support to the companies of the Group during the process of setting directional targets and the integration of these entities’ businesses as well as enhancing corporate governance.

KGHM conducted a review of its international assets. As a result the strategy was rationalised with respect to production by KGHM International and Sierra Gorda. This Chilean company is concentrating on the Debottlenecking Program, which is aimed at increasing average annual daily ore throughput to 130, and then 140 thousand tonnes based on existing infrastructure and necessary investments. The Owners of Sierra Gorda have approved among others the purchase of additional vertimills and a third flotation waste thickener, which are key elements of the Program.

In turn the revenues of the DMC Group were twice as high as in the prior year, amounting to over USD 200 million. The Company is working on further development of this part of our activities.

PLANS FOR 2019

Basic financial data of the KGHM Polska Miedź S.A. Group in the fourth quarter and 2018.

| in mn PLN | 4th quarter 2018 | 4th quarter 2017 | Change in mn PLN |

Change in % |

| Revenue | 5 739 | 5 871 | -132 | -2.3 |

| Cost of goods sold | 5 147 | 4 801 | +346 | +7.2 |

| Adjusted EBITDA* | 1 182 | 1 476 | -294 | -19.9 |

| Net result on sales | 592 | 1 070 | -478 | -44.7 |

| Profit for the period | 682 | -134 | 816 | +609.0 |

| in mn PLN | 2018 | 2017 | Change in mn PLN |

Change in % |

| Revenue | 20 526 | 20 358 | +168 | +0.8 |

| Cost of goods sold | 17 935 | 16 547 | +1 388 | +8.4 |

| Adjusted EBITDA* | 4 972 | 5 753 | -781 | -13.6 |

| Net result on sales | 2 591 | 3 811 | -1 220 | -32.0 |

| Profit for the period | 1 658 | 1 525 | +133 | +8.7 |

* Adjusted EBITDA including 55% of EBITDA in Sierra Gorda, which is consolidated by using the equity method.