KGHM and a consortium of banks support the development of Sierra Gorda – KGHM is changing the Group’s financing structure, enabling the further development of the mine in Chile

The Management Board of KGHM Polska Miedź S.A. decided to engage a syndicate of banks in the financing of Sierra Gorda under a new loan agreement. This is another strategic step to ensure financial stability and to enable the further development of this international copper asset of the company, the mine in Chile.

In June 2024 KGHM successfully issued bonds in the amount of PLN 1 billion under a new issuance program. These series C bonds have just debuted on the Catalyst market.

„This financial support allows the Sierra Gorda mine to continue its development, which is of key importance in achieving our long-term goals connected with our international assets. This is a step which will bring us measurable benefits both for the mine as well as for the entire KGHM Group.” – Iga Dorota Lis, Vice President of the Management Board (International Assets) of KGHM.

Transaction structure

The revolving credit facility agreement with a bank consortium in the amount of USD 500 million entered into with an international group of financial institutions confirms the scale of Sierra Gorda in KGHM’s portfolio and at the same time attests to the confidence of the financial sector.

The leaders in the transaction are Banco Santander S.A. and The Bank of Nova Scotia (together with Scotiabank Chile), with the additional involvement of the following banks: ING, HSBC, Sumitomo Mitsui, Intesa Sanpaolo, Mega Bank and banks in the ICBC group.

The financing granted enables the re-financing of existing liabilities, ensuring additional funds for subsequent investments and stabilisation of operations of the mine in Chile. KGHM, as the owner of 55 percent of Sierra Gorda, granted a corporate guarantee of up to USD 275 million.

“This operation will strengthen the financial liquidity of Sierra Gorda and will let us effectively manage our investments portfolio. It is a step which will strengthen our position on the global commodities markets.” – Piotr Krzyżewski, Vice President of the Management Board (Finance) of KGHM.

Piotr Krzyżewski also expressed his appreciation for the bank BGK for their cooperation thus far in the financing of Sierra Gorda.

Key assets and sustainable development

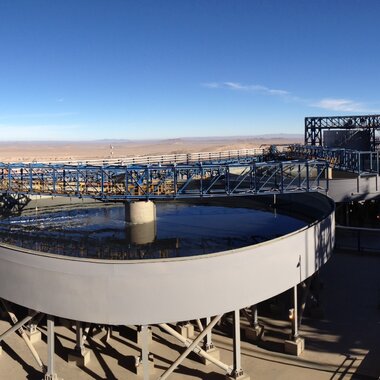

The Sierra Gorda mine, a key international asset in the KGHM Group, is a joint venture of KGHM INTERNATIONAL LTD. and South32 located in the Antofagasta region of Chile which extracts copper and molybdenum.

The decisions of the partners in the Sierra Gorda project concentrate on the implementation of optimisation programs aimed at improving the operations of the mine, the processing plant, infrastructure and the tailings storage facility, as well as at optimising costs.

The mine uses sea water in its facilities and, since 2023, has operated on the basis of Renewable Energy Sources, which makes it one of the most ecologically-friendly operations of KGHM. The mine is supplied with power from a solar power plant, located in the Antofagasta region. Green energy is one of the strategic goals of Sierra Gorda.