Solid financial and production results by KGHM for the first half of 2024

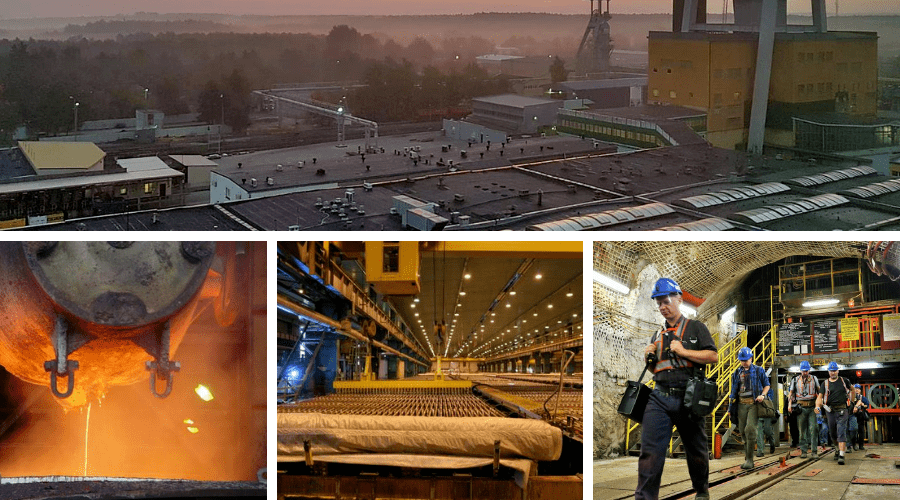

KGHM Polska Miedź S.A., one of the leading global producers of copper and silver, has presented its financial results for the first half of 2024. Despite market challenges, in the second quarter the Company recorded higher results as well as improved operational efficiency, alongside a clear decrease in production costs.

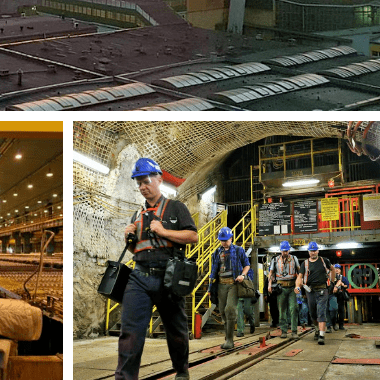

“We closed the second quarter with good results, the result of a new management approach to key issues for KGHM. As is the case for every mining company, we face challenges connected not only with reversing the trend of naturally-rising mining costs, but also higher costs of air cooling and transport logistics. To meet these challenges we need a responsible financing model. The Management Board is also working on updating the Strategy of the Company. This is what we are focused on,” said Andrzej Szydło, President of the Management Board of KGHM Polska Miedź S.A.

Reduced costs and effective operational management in the second quarter

The KGHM Group in the first half of 2024 reduced expenses by nature by 6 percent compared to the corresponding period of 2023. Total expenses by nature fell to PLN 16 394 million, or a decrease by PLN 977 million compared to PLN 17 371 million in the first half of 2023.

C1 cost, a key cost efficiency indicator in the mining sector, decreased to 2.76 USD/lb in the first half of 2024, compared to 2.95 USD/lb during the same period of 2023. In the second quarter of 2024 this indicator amounted to 2.71 USD/lb.

Substantially higher profit and EBITDA

KGHM ended the first half of 2024 with a profit of PLN 1 074 million, or a substantial, 2.7-times increase compared to PLN 401 million earned in the corresponding period of 2023. Consolidated adjusted EBITDA amounted to PLN 4 208 million, or an increase by 35.4 percent year-to-year. Such a substantial improvement in the results is the result of advancement of a variety of optimisation actions, including the effective management of costs and higher production efficiency.

The Company is continuing its ongoing investments, including projects such as the outfitting of the mines as well as building belt conveyors, replacing mining machinery, building mine dewatering systems, air cooling systems and the modernisation of electrorefining at the Legnica Copper Smelter and Refinery through conversion into fixed starter sheets technology.

Work also continues on the key Deposit Access Program as well as on exploring and assessing the deposits under the concessions held.

Optimising costs

Work continues in KGHM on analysing the financial situation and the specific capital needs of the Company and Group, as well as the review of the domestic and international operations, in terms of their potential given the changing market conditions and development goals.

In the coming months KGHM plans to complete work on updating the strategy, whose goal is to further improve operational efficiency and strengthen the Company’s position on international markets.